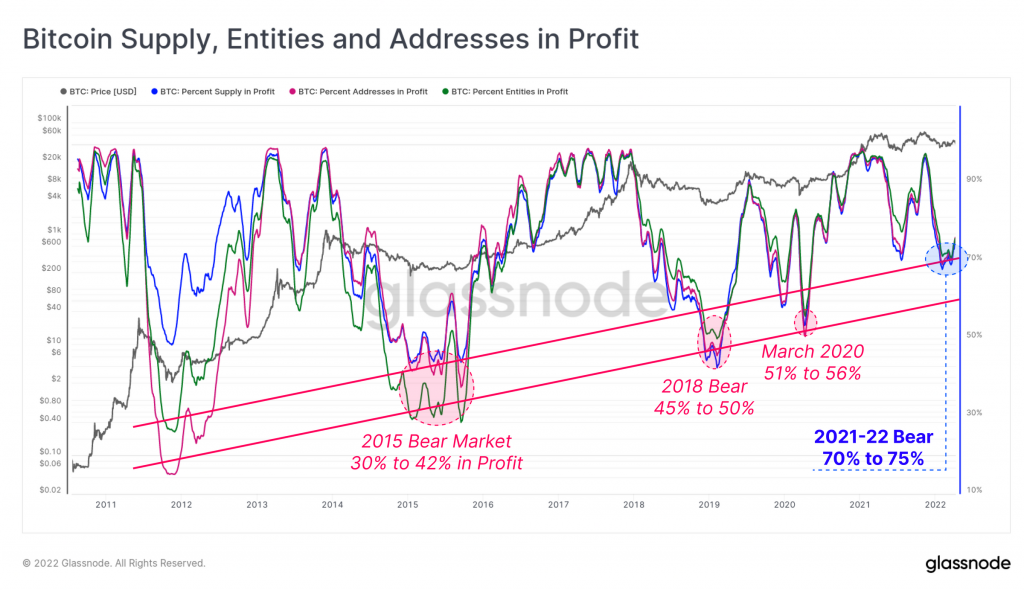

- Research from blockchain analytics firm Glassnode shows up to 75% of bitcoin wallets are in profit.

- Analysts say this suggests the current bear market is less severe than previous crypto downturns.

- The longer investors hold bitcoin, the less likely they are to be at a loss, the report said.

Blockchain analytics firm Glassnode said on Monday that, despite the recent price decline in the crypto market, almost three quarters of bitcoin wallets remain in profit.

"We can see that the current bear market is not as severe as the worst phases of all prior cycles, with just 25% to 30% of the market being at an unrealized loss," Glassnode's weekly newsletter said.

According to Glassnode's on-chain analytics, the current bear run is less severe than previous ones, although it did note that further sell-side pressure could threaten this. However, the report also pointed out that long-term holders (LTH) have been through this before.

"LTH coins are the least likely to be spent and sold on a statistical basis, and it can be seen in 2018 and March 2020 that they have held through much deeper losses in the past," Glassnode said.

Glassnode also showed that the bitcoin market is currently dominated by so-called HODLers – Holding On for dear Life – which means it's these long-term holders that are the majority. Glassnode said the longer investors hold bitcoin, the higher the likelihood of being in unrealized profit.

Bitcoin was last down around 2.1% at $39,965, according to CoinMarketCap data, although it's still down by more than 12% over the last week and by more than 16% for the year so far.